The Origins of Forex Foreign exchange dates back to the time the Ancient Egyptians, with evidence of coinage trading from as early as BC. Stemming from traditional bartering of items, forex began taking shape during the metal ages when gold and silver became the currency for bartering. - England formally adopted the Gold Standard 10/31/ · The internet created a market with unparalleled liquidity. Today, the forex market is the biggest market in the world, handling over $5 trillion in trades blogger.coms now have access to various Estimated Reading Time: 7 mins 11/6/ · Forex (FX) is the marketplace for trading currencies. The Forex market is a venue for currency exchange. Here, Trillions of Dollars are traded every single day. Since its history, Forex has no centralized location. The Gold Standard. In , $ equals an ounce of gold. This is

A brief history of Forex

The Forex market is a venue for currency exchange. Here, Trillions of Dollars are traded every single day, a brief history of forex. Since its history, Forex has no centralized location. This is the Gold Standard. Hence, paper money can be converted to gold and vice versa. In a brief history of forex Gold Standard system, the country fixes a price for gold, allowing for the buying and a brief history of forex of the metal at a specific price.

Countries stopped using the system in The American government cut the connection between gold and the USD in This led to the complete abandonment of the Gold Standard.

Fiat money replaced it. The system uses gold to limit the money issuance. This safeguards the economy against inflation and deflation. It also helps foster a stable economy that promotes generation a brief history of forex jobs.

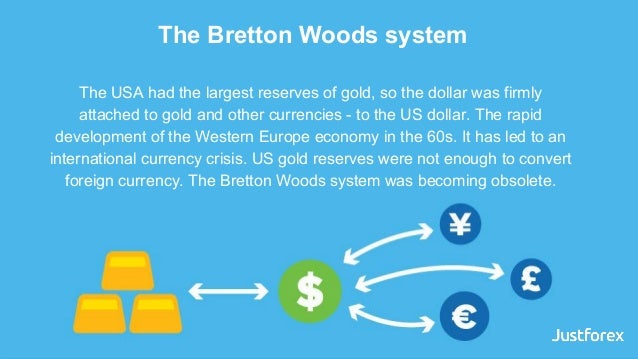

The Bretton Woods Agreement named in light of its venue in New Hampshire was made in July It came into full effect in Its primary goal was to prevent devaluation of currencies. This promotes economic advancement, a brief history of forex. The United Nations Monetary and Financial Conference delegation included almost participants that stood for 44 countries. However, in a devaluation of This prompted then President Nixon to leave the A brief history of forex Standard in This decision is takes cues from supply and demand relations as opposed to a Fixed Exchange Rate wherein the government sets the rate.

In Free-Floating Systems, long-term currency price changes may mean both good economic performance and presence of differentials in interest rates between countries.

Should supply overtake demand, the currency rates fall. However, should demand take the upper hand, the currency rates rise. Taking short-term actions to the extreme prompts central banks to mediate. Central banks and governments have to take action once currencies rise exponentially or sink devastatingly. Next to the USD, the Euro is the most traded currency. On January 1,the currency was named Euro. It was launched as a currency for accounting, replacing the European Currency Unit ECU.

InEuro coins and notes went into circulation. Online trading began in the early s. A popular form of derivative trading, CFDs pertain to leveraged products. CFDs do not give one ownership of the asset. Instead, a brief history of forex, one is allowed to take a position upon speculation whether values will either rise or fall. These days, common folk are already investing time and money in trading. Analysts agree that the Forex market will only continue to grow.

More market participants would mean speedy and adaptable reactions to global political, economic, and social events or even natural occurrences.

This will also lead to greater market volatility. More regulations that are stringent will also influence existing market participants and attract more traders. Paid trading platforms, systems, marketing techniques, and trading strategies will only continue to be developed. Forex FX is the marketplace for trading currencies.

The Bretton Woods System The Bretton Woods Agreement named in light of its venue in New Hampshire was made in July The Beginning of the Free-Floating System The Bretton Woods System outlined the guidelines for a fixed exchange rate system.

Establishment of the Euro Next to the USD, the Euro is the most traded currency. Forex Trading in the Internet Online trading began in the early s.

Leveraged products are a double-whammy. While it can magnify profit, it can also magnify losses. The Future of Forex Trading These days, common folk are already investing time and money in trading.

1. Introduction to FOREX Trading తెలుగు లో

, time: 9:20A brief history of Forex — Forex Columns — blogger.com

3/18/ · The Pre-history of Forex Trading It was in BCE that the Babylonian state first emerged, with rudimentary forex trading principles used to create a system for the exchange of currencies. Typically, this system saw the exchange of gold for other tangible goods, with other precious metals such as silver also emerging as viable tools of transaction shortly afterwards A Brief History of Forex Trading? You could say, the forex market is the largest and most liquid market in the world with a trade amounting to trillion US dollars every day! However, to be able to reach the size of the market as it is today, forex trading has a long history 1/11/ · With constant developments in the world; the introduction of the internet and the computer, Forex continues to evolve becoming more sophisticated and faster than ever. From the days of the gold standard, we have now reached a new age where someone sitting at home with just the click of a button can find a price that would have involved a lot of manpower

No comments:

Post a Comment