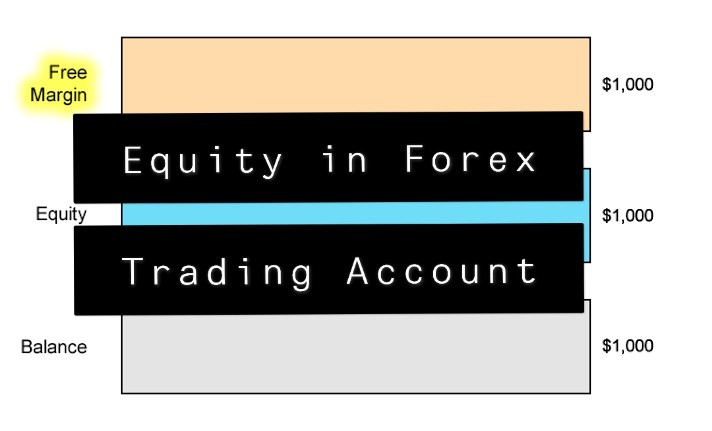

11/2/ · What is equity in Forex? FX equity refers to the absolute value of a Forex trader's account. When a trader has open positions, their trading platform will factor a number of parameters into the equity equation. For example, in MetaTrader 4 (MT4), the charts will list a number of figures in the terminal window: The first parameter to understand equity in Forex is blogger.comted Reading Time: 7 mins 6/25/ · GBP/USD, “Great Britain Pound vs US Dollar”. GBPUSD is consolidating around Today, the pair may fall towards and then form one more ascending structure to 6/14/ · After completing the descending structure at , EURUSD is consolidating above this level. Today, the pair may expand the range down to

Forex Price Quotes for all Forex Markets - blogger.com

Foreign exchange forex traders are always looking for trends and economic outlooks to predict the potential movement in a currency. Some look at economic reports, the gross domestic product GDPor trade relations, but you might be able to predict these reports using the equity markets. Equity markets have thousands of firms around the world producing hundreds of reports every day that can be a useful source of information for currency traders. Ultimately, all forex equities, a currency fluctuates based on supply and demand characteristics.

When more investors demand a currency, it will likely strengthen relative to other currencies. When there is excess supply, the opposite is true. This fundamental principle, however, is influenced by many factors that lead to constant currency fluctuations each and every day. It is beyond the scope of this article to discuss many of these factors. The focus will be on how equity markets can provide an insight into the foreign exchange markets. The foreign exchange markets are truly a global market; bigger than any other securities market.

So when thinking about equities and their influence on forex markets, you truly have to think globally. The best companies to consider are naturally the ones with international operations that transact in various currencies. For example, as the biggest retailer on the planet, All forex equities deals with foreign exchange issues just as much as any other company you could think of. Another great name is Coca-Cola. These global consumer stocks transact with consumers all over the world and provide the best corporate glimpse into the forex market.

The commodities market can also be useful with respect to the forex market. Consider the main global commodity, all forex equities, crude oil. Global oil prices are denominated in U. As an example, the price of oil can spike because the value of the U. dollar declines relative to major global currencies. So the price of oil has to go up in order to equalize the price that other foreign countries buy in their home currencies.

While other global commodities—sugar, corn, and wheat—offer similar insights, oil is the most significant commodity that relates all forex equities the foreign exchange markets.

A major equity market can also influence forex markets in another way, all forex equities. A weak currency favors exporters in that particular country, all forex equities. When your domestic currency all forex equities weak, exports are cheaper abroad.

That helps fuel the growth and profits of those exporters. When earnings are growing, equity markets tend to do well. Of course, the situation is most likely to occur in equity markets backed all forex equities the major global currencies: the U, all forex equities.

dollar, the yen, the euro, and the British pound, among others. Because foreign exchange markets are dynamic and fluctuate very quickly, most industries serve as lagging indicators for the direction of forex markets. It's not until a company reports its earnings that one begins to know the effect of currency movements.

Often, the company's results will be vastly different from analysts' estimates when forex has played a major role. It is at that point that investors can analyze the comments from management with regard to the future outlook of currency fluctuations, all forex equities. Things to look for are any indications of hedging strategies that a company will take going forward.

Trying to differentiate what types of assets—hard or soft—best identify forex movements is meaningless. Rather, what is important is the necessity of the asset. Things like food, gasoline, and medicine would be more useful than clothing or jewelry. A company like Kraft, which sells food all over the world, would be more useful than Tiffany's, the iconic jewelry store retailer.

One would think that global financial institutions would serve a meaningful purpose in forex markets. They do in the sense that they help facilitate forex markets, but in terms of identifying direction, remember that the value of their main material—money— is influenced by government policy. Unfortunately, equities don't provide any meaningful leading indicators. The value of money is determined by its supply and demand, which is generally determined by the government via interest rate changes or other policy movements.

Trying to use equities as a leading indicator would not be wise when governments can influence movements at will. The reality is that equities alone are not a prudent way to predict the direction of currencies. Government balance sheets, monetary policyand interest rates play a major role in forex markets.

There has been one major pattern that has emerged over the years, all forex equities. Many global businesses have been focusing their growth efforts outside the U. The best growth is coming from emerging and developing markets.

Nearly all global companies have focused significant growth efforts in developing and emerging parts of the world. The viewpoint of growth from abroad has coincided with a weaker dollar at the expense of other currencies. While it is no guarantee, strong economies are usually supported by strong currencies over the long run, all forex equities. Investors should clearly understand that short-term fluctuations are the rule, not the exception when it all forex equities to foreign exchange markets.

When a nation all forex equities heavily indebted or has to continue issuing currency, the long-term effects on that currency are not favorable. During the financial crisis in the U. dollar, all forex equities, even though Japan's economy had been in a funk for decades.

economy at the time was falling faster than Japan's economy. Where global companies invest is often a leading all forex equities that those companies see strong economic growth. Where there is strong economic growthall forex equities, there is usually greater demand for the currency.

More importantly, a strong economy often suggests a solid government balance sheet that helps support currency prices. Forex markets are complex dynamic markets. Using one data point—such as equities—to forecast future forex directions can be a limiting exercise.

Equities can be useful indicatorsall forex equities, all forex equities investors should be aware that equities alone may not be sufficient to provide an accurate assessment. Your Money. Personal Finance. Your Practice. Popular Courses. Key Takeaways Currencies fluctuate based on their supply and demand. When investors demand more of a currency, it will strengthen relative to other currencies.

When there is an excess supply of a currency, it will weaken relative to other currencies. Focusing on certain equity stocks can provide insight into the foreign exchange market because these companies are large, deal on a global scale, and transact in various currencies. When a domestic currency is weak, exports are cheaper abroad, which helps fuel the growth and profits of those exporters.

The hedging strategies that companies mention in their quarterly earnings reports are an indicator of the future outlook of currency fluctuations. Where there is strong economic growth, there is usually greater demand for the currency. Equities alone are not a prudent way all forex equities predict the direction of currencies. Government balance sheets, monetary policy, and interest rates play a major role in forex all forex equities. Article Sources.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Related Articles. Bitcoin How To Trade Forex With Bitcoin.

Gold The Best Strategy for Gold Investors. Partner Links, all forex equities. Related Terms Currency Convertibility Currency convertibility is the degree to which a country's domestic money can be converted into another currency or gold. Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency. What Is Forex FX and How Does It Work? Forex FX is the market for trading international currencies.

The name is a portmanteau of the words foreign and exchange. Forex Analysis Definition Forex analysis describes the tools that traders use to determine whether to buy or sell a currency pair, or to wait before trading.

ETB Ethiopian Birr Definition and History The Ethiopian birr ETBthe national currency of the Federal Democratic Republic of Ethiopia, is issued by the National Bank of Ethiopia. Foreign Currency Effects Definition Foreign currency effects are gains or losses on foreign investments due to changes in the relative value of assets denominated in another currency.

About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

Chart Patterns \u0026 Trend Action for Forex, CFD and Stock Trading

, time: 38:05What is Equity? - blogger.com

6/24/ · Free Forex Signals – XM Group. $30 No Deposit Bonus For Asia – JustForex. EURO Contest, $50K Fund – SimpleFX. HONDA CIVIC GIVEAWAY – Fast FX. $10K Cash Prize Money, 2 Months Contest – IronFX. Gold Rewards Contest – blogger.comted Reading Time: 2 mins 4/16/ · The Nikkei, similar to the Dow Jones Industrial Average, is the most widely quoted average of the Japanese stock market. It is a price-weighted average of the top companies and is supposed to be reflective of the overall market. The Nikkei includes Estimated Reading Time: 5 mins 6/14/ · After completing the descending structure at , EURUSD is consolidating above this level. Today, the pair may expand the range down to

No comments:

Post a Comment