5/31/ · Elliott Wave Forecast is a leading technical analysis firm helping traders around the world make smarter trading decisions. Daily coverage of Stocks, ETFs, Indices, Forex, Commodities, Bonds & Cryptocurrencies 5/26/ · Hi all, started this thread to discuss Elliott wave trading. Feel free to discuss and post charts.. Rules for EWP: Wave 2 should not break below the beginning of Wave 1. Wave 3 should not be the shortest wave among all 1, 3 and 5 waves. Wave 4 should not overlap with Wave 1, except for diagonal waves. Post So basically, Elliott wave fractals are the smaller Elliott wave patterns within the bigger Elliott wave patterns. Put simply, Elliott Wave fractals are “Elliott waves within Elliott waves”: These Elliott wave fractals do create a one big problem for many forex traders on real live trading blogger.comted Reading Time: 8 mins

Elliott Wave Forex Trading

The Elliott wave theory, or some call it the Elliott Wave Principle Elliott wave analysis and how to trade Elliott wave forex trading Waves can be a mind boggling trading concept to understand especially for a new forex trader.

Elliott Wave Theory and How to trade it, is without doubt one of the most difficult trading concepts to understand because you are now just focusing on one or two things but quite a handful of them. There are two things that make many forex traders stay away from trying to elliott wave forex trading how to trade Elliott Waves:. the basic Elliott wave theory itself can be understood if you spend a bit more time on it but the application part in real time trading is what gets most traders lost…and I mean SERIOUSLY lost in some cases.

Elliott wave trading is not that easy to understand…at first. As a matter of fact, the easiest part is the theory part. And if that is the part you want to take, I hope that what you learn here will take you a long way….

He was the guy who came up with this Elliott Wave Theory. He analysed 75 years worth of stock data and stumbled upon a elliott wave forex trading about the behavior of the stock market.

This is the discovery: stock prices do not move chaotic manner but in repetitive cycles. He published his theory in a book called The Wave Principle when he was about 66 years old. According to Mr Elliott, elliott wave forex trading, these repetitive cycles of stock prices were the results of:. Elliott explained that the downward and upward swings in stock market prices caused by the collective mass trading psychology always show up in the same repetitive patterns.

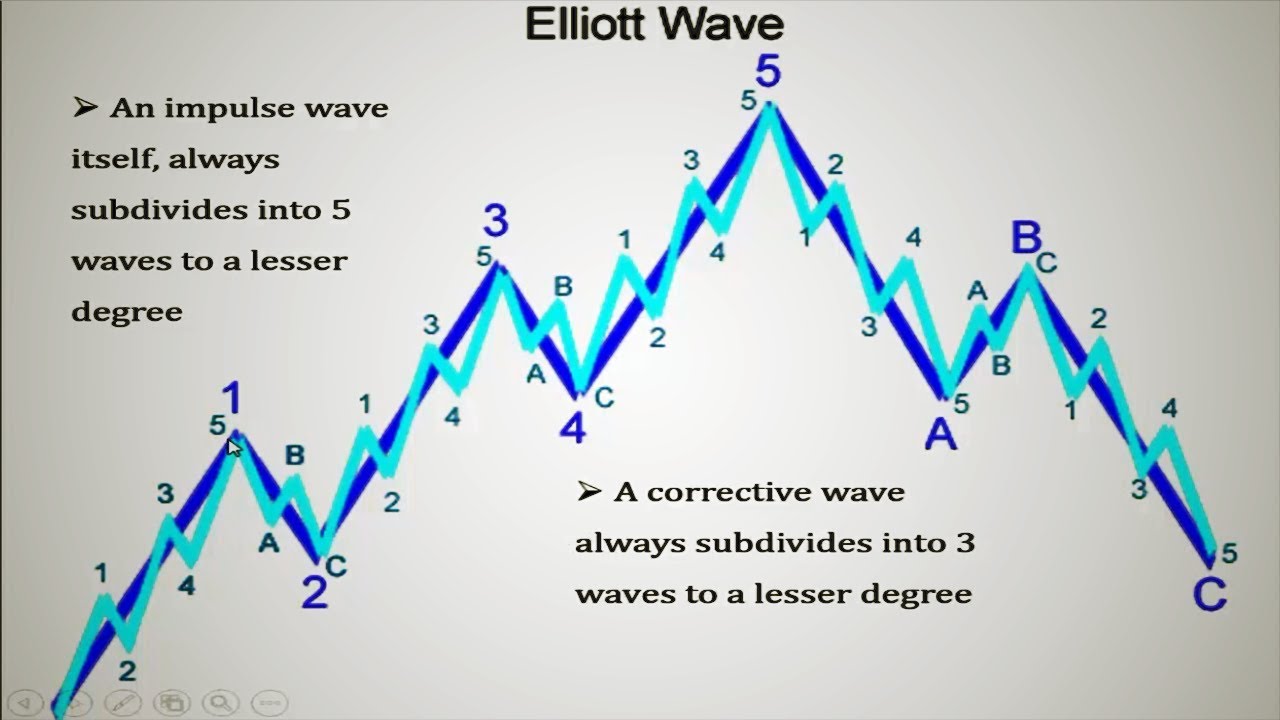

And so Elliott explained that if you know the structure of these wavesthen you can correctly predict where price will go next or not go. Elliot named this discovery after himself, calling it the The Elliott Wave Theory. So put simply, the Elliott wave theory helped traders find order and structure in a chaotic market! This is the theory of Elliott Wave: Mr Elliot said that in a trending market, price moves in a wave pattern. The chart below shows the structure of the 5 wave pattern or sequence.

As you can see the trend is up. Remember this: impulse or motive waves go with the main trend and corrective waves go against the trend, elliott wave forex trading.

Well, price goes into what is called a corrective wave elliott wave forex trading sounds really fancy so let me make it easier for you to digest: after the 5 wave sequence, expect price to start developing a pattern to change the trend direction. For example, if the trend was up then after the 5 wave sequence has developed fully then expect the market to start turning and head down, forming a downtrend!

So in addition to the 5 wave sequence, you now have 3 more waves, which is called the corrective wave pattern.

Now, these 3 additional waves are not numbered 6, elliott wave forex trading, 7 and 8. Now, if you bring the basic 5 wave pattern and the 3 wave pattern together, you get a complete Elliott wave cycle that consists of 8 waves and looks like this in an uptrend market:. Ralph Elliott divided this complete wave cycle into two distinct parts, the impulse and corrective wave parts.

The impulse phase is represented by the 5 wave sequence and abc waves represented the correction of the main trend or the larger impulse phase. What are fractals? Fractals are structures that can be split into parts and the split parts will be a very similar copy of the whole part that they split from, elliott wave forex trading.

So basically, Elliott wave fractals are the smaller Elliott wave patterns within the bigger Elliott wave patterns. These Elliott wave fractals do create a one big problem for many forex traders on real live trading charts.

If you are wondering why the 3 Elliott wave guidelines are important then here are the reasons why:. Now lets get to what you are really here for: how to actually apply the Elliott wave theory to real live trading. Well, elliott wave forex trading, I got bad news for you…the real live trading forex charts are not like that at all.

In this section, elliott wave forex trading, I will show you some examples of real charts based on live market conditions and show you techniques on how to trade Elliot Wave patterns, elliott wave forex trading. The two best Elliott waves to enter trades on are the corrective waves 2 and 4 as shown on the chart below. If you get into a trade and based on your elliott wave forex trading you see that you are riding the 5th wave, it would be the ideal time to:.

It looks and sounds complicated but really it is very simple…it is all about support levels being broken and resistance levels being broken causing downtrends and uptrends respectively. One of the best places where trend changes occur are on support and resistance levels. If you can identify them and wait for price to hit them and then start your first count 1 as price starts moving up or down.

But you can trade wave 1 move using methods like trendline trading strategy which allows you to ride that first wave 1. Step 3 is to Start your wave 2 Count and prepare to take your first trade based on Elliott Wave Theory! Sit up straight now because this is where you will be entering your first trade based on the Elliott Wave! In addition to that, you need to know your reversal candlestick patterns that will confirm your trade setup on these fib levels.

Here are the Bullish Reversal Candlestick Patterns you should be looking out for when wave 2 is forming and hits those Fibonacci retracement levels:. Similarly, there are the Bearish Reversal Candlestick Patterns you should also be watching out for in a downtrend when wave 2 is forming:. These bullish and bearish reversal candlesticks above do really help so you need to remember them.

Step 5 is to start your wave count 4 so that you can take a trade just as wave 4 is ending so that you can ride out wave 5. Assuming all is going out as predicted, this is where you will enter your 2nd trade based on the Elliott wave theory. You know that based on the Elliott Wave Elliott wave forex trading, the market starts to loose its steam once wave 5 goes past the high of wave 3. If you start counting and if these waves mentioned above fail to satisfy the rules, that waves becomes null and void which means you have to start your counting again.

If you think so, why not share your appreciation by clicking those sharing buttons below and share it? And guess what? That is not the complete list! The application of the Elliott Wave theory in real time trading gets difficult because the charts look messy. Where do you being the wave count? Is this the 1st wave, the 2nd, the third. Is this the 5th wave?

The hardest part is the application part! Well, some do! Who Developed The Elliott Wave Theory? According to Mr Elliott, these repetitive cycles of stock prices were the results of: investor emotions caused by outside influences or trading mass psychology at that time Elliott explained that the downward and upward swings in stock market prices caused by the collective mass trading psychology always show up in the same repetitive patterns.

And he called elliott wave forex trading swings, waves. Elliot Wave Analysis This is the theory of Elliott Wave: Mr Elliot said that in a trending market, price moves in a wave pattern. And in this elliott wave forex trading pattern, there are two types of waves: the first wave pattern is called the impulse wave the second wave pattern is called the corrective wave.

So what are impulse waves? Impulse waves are waves that move in the direction of the main trend. What are corrective waves? Corrective waves are waves the move in against elliott wave forex trading main trend. Now, let me go through each of these elliott wave forex trading The Basic 5 Elliott Wave Pattern The chart below shows the structure of the 5 wave pattern or sequence.

Note that: waves 1, 3 and 5 are impulse waves waves 3 and 4 are corrective waves. This is the most basic impulse advance 5-wave Elliott wave sequence. Image Source:www. Image Soure:stockcharts. Image Source:stockcharts. Image source:stockcharts. RELATED Learn How To Use Fibonacci Confluence Zones In Forex.

Prev Article Next Article. You are a great teacher. Taking a complex subject and simplifying it. Kind regards. excellant work sir ,,,great ….

My Personal Winning Elliot Wave Theory Trading Strategy And Opinion

, time: 11:156 Best Forex Trading Platforms in - Elliott Wave Forecast

11/13/ · This event is clearly identified with the Elliott wave indicator for Forex trading. When a correction is spotted, and then confirmed by the EWO, you will find that wave two and four are always the corrective ones. Another rule of thumb is that good traders always combine the corrective waves with Fibonacci blogger.comted Reading Time: 5 mins 5/31/ · Elliott Wave Forecast is a leading technical analysis firm helping traders around the world make smarter trading decisions. Daily coverage of Stocks, ETFs, Indices, Forex, Commodities, Bonds & Cryptocurrencies 2/5/ · An Elliott wave is defined as the movement from a price peak to a price trough or a trough to a peak. A cycle comprises two waves: an impulse wave and a corrective wave. In a bullish trend, the impulse direction is upwards, and the corrective direction Estimated Reading Time: 7 mins

No comments:

Post a Comment