Mar 12, · The GDP ‘sweet spot’ varies from one country to another. For example, China has had GDP in double digits. Forex traders are most interested in GDP Estimated Reading Time: 4 mins Apr 03, · Key quotes. ADB slashes China’s GDP forecast to % vs. % previous estimate. Sees China much lower this year. China’s growth forecast seen unchanged at %.Author: Dhwani Mehta Apr 23, · China has conditions to keep the balance of international payments and foreign market, the State Administration of Foreign Exchange (SAFE) said on Friday, responding to market concerns that the U.S. Federal Reserve will end its loose monetary policy early. The concerns came against the backdrop of a U.S. economy picking up from the COVID

China able to keep intl payments, forex market balanced: official - CGTN

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies.

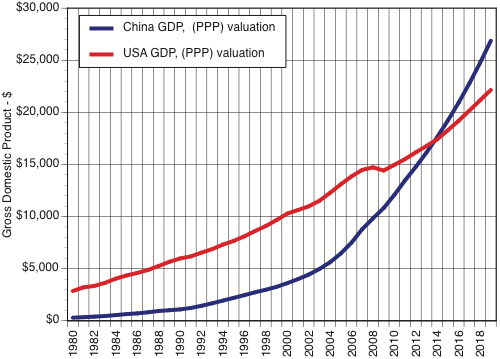

You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. See our updated Privacy Policy here. Note: Low and High figures are for the trading day. GDP Gross Domestic Product economic data is deemed highly significant in the forex market. GDP figures are used as an indicator by fundamentalists to gauge the overall healthand potential growth of a country. Consequently, greater volatility in the forex market is closely observed during the GDP release, forex market vs china gdp.

Usually, GDP is measured in three different time periods: monthly, quarterly and annually. This enables economists and traders to get an accurate picture of the overall health of the economy. Understanding the relationship between GDP and the forex market. The general rule of thumb when looking at GDP data is looking at whether figures beat or fall below estimates see relevant charts below :.

GDP reports do not always have the same or expected effect on currencies. This is important to keep in mind before committing to a trade. Related economic data reports regularly allow for the market to ascertain a somewhat accurate estimate. Data to look out for:. The advance release of GDP is four weeks after the quarter ends while the final release happens three months after the quarter ends.

Both are released by the Bureau of Economic Analysis BEA at Forex market vs china gdp. Typically, investors are looking for US GDP to grow between 2. Maintaining price stability is one of the jobs of the Federal Reserve. GDP should not be high enough to trigger inflation or too low where it could lead to recession.

A forex market vs china gdp is defined by two consecutive negative quarters of GDP growth. For example, China has had GDP in double digits, forex market vs china gdp. There is usually a positive expectance for future interest rate hikes because strong economies tend to get stronger creating higher inflation.

This, in turn, leads to a central bank raising rates to slow growth and to contain the growing specter of inflation. On the other hand, a country with weak GDP has a drastically reduced interest rate hike expectation.

In fact, the central bank of a country that has two consecutive quarters of negative GDP may even choose to stimulate their economy by cutting interest rates. Quarter-on-quarter figures tend to produce much more variable changes in the overall trend — e.

Positive GDP figures beating estimates QoQ may be fleeting when taking into consideration year-on-year YoY data. YoY data allows for a broader perspective which could potentially highlight an overall trend. This chart expresses the variation in short term QoQ data against the longer-term YoY trend.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Leveraged trading in foreign forex market vs china gdp or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. FX Publications Inc dba DailyFX is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association ID Registered Address: 32 Old Slip, Suite ; New York, NY FX Publications Inc is a subsidiary of IG US Holdings, Inc a company forex market vs china gdp in Delaware under forex market vs china gdp Sign up now to get the information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content.

For more info on how we might use your data, see our privacy notice and access policy and privacy website. Check your email for further instructions.

Live Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Events 0. Duration: min. P: R:. Search Clear Search results. No entries matching your query were found. English Français 中文(繁體) 中文(简体). Free Trading Guides. Please try again. Subscribe to Our Newsletter. Market Overview Real-Time News Forecasts Market Outlook Market News Headlines, forex market vs china gdp.

Forex market vs china gdp Live Chart Asset classes. Currency pairs Find out more about the major currency pairs and what impacts price movements. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Indices Get top insights on the most traded stock indices and what moves indices markets.

Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Economic Calendar Central Bank Calendar Economic Calendar.

RBA Gov Lowe Speech. Industrial Production YoY Prel MAY. P: R: Trading courses Forex for Beginners Forex Trading Basics Learn Technical Analysis Volatility Free Trading Guides Live Webinars Trading Research Trading Guides, forex market vs china gdp. Company Authors Contact. of clients are net long. of clients are net short, forex market vs china gdp.

Long Short. News US Yields Going Which Way? Stocks Keep Climbing; Bitcoin Line in the Sand - The Macro Setup Oil - US Crude. Crude Oil Price Forecast: A Slow and Steady Grind Higher, but Red Flag Appears Wall Street. US Yields Going Which Way? More View more. Previous Article Next Article. A Guide to GDP and Forex Trading Warren VenketasMarkets Writer. What forex traders need to know about GDP What is GDP? Data to look out for: ISM data PPI data Analysing GDP data to inform currency trading decisions GDP, Inflation and Interest Rates The advance release of GDP is four weeks after the quarter ends while the final release happens three months after the quarter ends.

Trading currency pairs using GDP data Quarter-on-quarter figures tend to produce much more variable changes in the overall trend — e. CPI is released monthly by most major economies to give a timely glimpse into current growth and inflation levels.

Fundamental traders monitor economic data releases, and many do so with the intention of trading the news. It is essential that traders adopt sound risk management when doing so as volatility can spike immediately after important releases. Foundational Trading Knowledge 1. Forex for Beginners. Forex Trading Basics. Why Trade Forex? Forex Fundamental Analysis. Find Your Trading Style. Trading Discipline. Understanding the Stock Market. Commodities Trading.

html'; this. createElement 'script' ; s. js'; s. setAttribute 'data-timestamp', forex market vs china gdp, new Date ; d. head d.

The Economics of Foreign Exchange

, time: 14:36A Guide to GDP and Forex Trading

Mar 12, · The GDP ‘sweet spot’ varies from one country to another. For example, China has had GDP in double digits. Forex traders are most interested in GDP Estimated Reading Time: 4 mins Jun 04, · The forex market is the most actively traded market in the world, with an excess of more than $5 trillion traded daily, far exceeding global equities. Despite such enormous trading volumes Apr 23, · China has conditions to keep the balance of international payments and foreign market, the State Administration of Foreign Exchange (SAFE) said on Friday, responding to market concerns that the U.S. Federal Reserve will end its loose monetary policy early. The concerns came against the backdrop of a U.S. economy picking up from the COVID

No comments:

Post a Comment