Forex Trading Journal Excel and Cryptocurrency Trading Journal. To create a Forex Trading Journal Excel, you can follow the procedure just illustrated, just as you could create a Crypto Trading Journal or a Stock Trading Journal Spreadsheet. To create a Cryptocurrency trading Journal, edit the drop-down list in Excel by entering your favorite Reviews: 2 6/1/ · Cheers Trade blogger.com ( KB) Free Excel Trading Journal. Trading Tech and Tools. Stray. June 1, , am #1. Hi Guys, I am new to this forum but thought I would post a template of my trading journal I have just made because after searching the net I couldn’t find one that exactly fitted my needs so I made this blogger.comted Reading Time: 5 mins Trading Journal. Start recording your trades with TraderSync and let our powerful journaling show you the path to minimize your mistakes. Journal Trades. The simplest yet most powerful stock trading journal to date. Build a vault of valuable information that can be analyzed at any time from anywhere. Stop Losing blogger.comted Reading Time: 2 mins

Free Excel Trading Journal - Trading Tech and Tools - blogger.com Forex Trading Forum

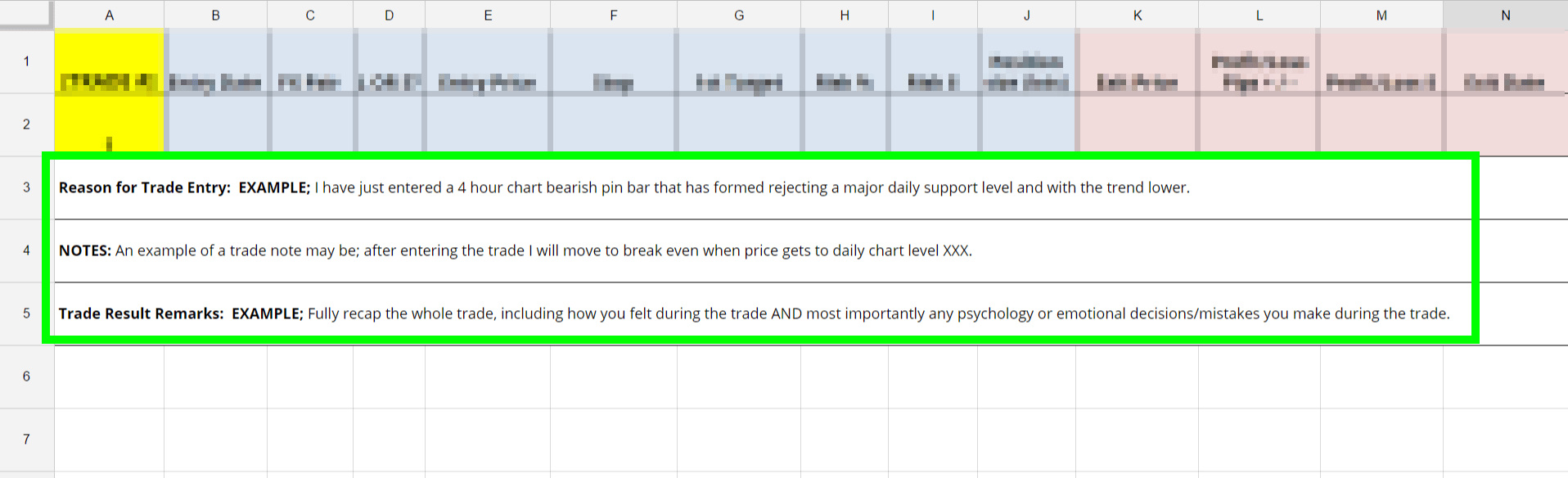

A trading journal helps you recognize patterns in your trading. Whether you're too emotional, too passive, trading too much, or too little. Having a clear record of forex trading journal trades will let you see through all the noise and optimize forex trading journal strategy going forward.

Over time your journal will become your secret weapon in getting an forex trading journal over other traders. In this article, we'll take a look at the top journaling tools on the market today, explain what a forex journal is, and show you how to make your forex trading journal. A forex trading journal is a chronological record of the forex trades you make. A trading journal has the following basic components:. You may include personal views of the market in your trading plan, such as:.

Keeping a journal is one of the most underrated activities by forex traders by both beginners and experts. It can be an invaluable tool in your trading career. Here are some of the top reasons to use forex journals. When you trade for longer periods, it will be harder to remember all the trades you made just from memory, making it even harder for you to keep track of your trading progress. You won't know if your chosen strategies are profitable or if you accomplished any of your trading objectives.

With a trading journal, however, you can easily monitor your trading activities and progress. The trading journal enables you to map your growth as a trader.

The journal will help you identify if you're profitable or bleeding capital in the long term. Since it gives an overview of all your trading activities, it becomes easier for you to look back at your trades retrospectively, which may inspire you to become a better trader, forex trading journal.

A forex trading journal keeps a detailed record of your past trading activities. This data is invaluable since it helps you discover your strengths and weaknesses as a trader. Looking at your longer-term records will help you determine if you are sticking to your trading plan and if that plan is working.

If your long term track record is not profitable, you can easily pinpoint which strategy is not working and tweak it. Similarly, if you notice that the rationale you use to open and close trades have been emotions-based and are hurting your trades, you may decide to adopt automated trading to improve your track record.

When you journal your trades, it's advisable to do so within a few minutes of opening or closing your trades. This way, when you note down the general market trends, all the details are still fresh in your memory, forex trading journal. Why is this important? When you compile your notes on the trends, you may be able to notice if your entry timing is too early or too late, forex trading journal. We presume that you are opening and closing your trades based on a logical trading plan.

Thus, observing a compilation of the asset's general trend when you open and close a trade will significantly help you identify the points on trends and patterns when it is optimal to open or close a trade. In this case, practice makes perfect. Here are our picks of the best forex trading journals in TraderSync, Trademetria, and Tradervue. Forex trading journal is one of the best trading journals available in the market, and it supports over brokers in Stocks, options, Futures, Future Options, and Forex.

Trade Journaling — One of the basic features of TraderSync is trade journaling. You have the option of importing your trades or manually entering the trades, forex trading journal. Manually entering trades involves typing in all the details of a particular trade you took.

TraderSync allows you to add screenshots of price charts and add them to your notes. When you do this, it will automatically annotate the charts you upload with the entry and exit points, including the stop loss and take profit levels. For beginner users, it is recommended to import your trades directly from your broker into your TraderSync.

Customizable dashboard — The TraderSync dashboard has over 20 widgets that you can use to customize and reflect on specific data about your trades. You can sort your trades depending on the available data filters on the platform's dashboard. Some of them are: setup, side, mistakes, status, forex trading journal, portfolio, entry price, asset, forex trading journal change, and volume change. With these, you can view your past trades depending on some specific features you select.

This eliminates the tedious practice of going through trades one at a time. The platform has an AI engine that will analyze all the information in your journal and identify patterns in your trades, then generate a simple-to-understand report for you. These patterns are based on the AI-generated evaluation of your past trades. You can simulate different trading scenarios based on your trading history to determine which one would be forex trading journal profitable.

Calendar Reporting — TraderSync has a calendar reporting feature that allows you to see your trade performance on a particular day.

Trade Management — This feature allows you to create a specific trade strategy, i. TraderSync will automatically track your trades and alert you if you are following your forex trading journal strategies. It will plot your trades and identify which ones stuck to your plan and which trades deviated from your strategies. Performance at a glance — TraderSync generates an automatic performance report of your trading account.

These include metrics such as profit factor, percentage of average return, the average return in dollar terms, forex trading journal, and win ratio. Performance sharing — TraderSync allows you to share your trading performance on social media. Your contacts can view your trading history, performance reports, and trade executions.

Pricing — TraderSync has four plans — basic, pro, premium, and elite, forex trading journal. Trademetria is a journaling software, trade analyzer, and portfolio tracker.

It gives you all the tools you'll need to understand your trading performance and improve your trading skills. Trade Journaling — With Trademetria, you can automatically import your trades or manually type them into your trading journal.

The trading journal's available fields include trade side long or shortdate, quantity, price entry and exitcommission, trade time, notes, forex trading journal, and tags. You can also generate several reports from Trademetria, which give you an overview of your trading activities at a glance.

They include day trader report, forex trading journal, win ratio, profit factor, total trades, average net per trade, and historical performance. Trade calendar — Trademetria has a calendar that tracks the timing of when you opened and closed trades. With this calendar, you can view your trading performance daily, weekly, or monthly. Monitor multiple accounts — You can add multiple trading accounts dealing with different tradable instruments on Trademetria. Since the trading journal has over 30 key metrics, you can track your past and current trades in these accounts using all these metrics.

Trademetria aggregates all forex trading journal accounts with different brokers and displays a summary of their collective performance. Charting — Trademetria doesn't have charting software but links assets to charts in TradingView. Fees — All users get a free monthly trial account for free. The difference between these packages is the number of accounts you can add and real-time quotes. This helps filter out losing strategies.

Tradervue is a trading journal, trade analyzer, and social platform for traders. The platform supports different asset classes, including stocks, futures, and forex. Auto-import — You can import your trading history directly from your broker — Tradervue supports over 70 brokers. If your broker is not supported, forex trading journal, you can manually input your trading activity onto the platform.

You can add personalized notes alongside individual trades as you please. More so, users can also add daily notes on their trading journal, which is a recap forex trading journal the entire day's trading activities. Automatic Price Charts — After you have imported your trading activity into your journal, Tradervue automatically generates charts of multiple time frames for individual assets.

Entry and exit points of your trades are marked on these charts. Trade Tagging — Tags are filters you can attach to your trades, enabling you to review particular trades in the future.

Tags can be a specific system of trade you choose or even personal comments. If you have hundreds of trades, these help you pull up specific trades and make comparisons.

Trade summary — Your account's trading activities are summarized on the Tradervue dashboard. The dashboard shows a recap of forex trading journal trading activities and any activities you forex trading journal shared with other traders on the platform.

It also shows recent trades on similar assets that other users have made. You can use the filtering option to review only specific trades, forex trading journal. You can look up trades by the asset, duration of the trade, date, or tag.

Analysis feature — With Tradervue, you can track the overall profitability of your trading activity. You can view the performance of your account over a selected period, forex trading journal. This includes your win percentage, traded volume, and profitability. You may also generate detailed reports and statistics of your trading activity. This feature helps you to understand your trading activities deeply.

You can generate this report based on several filters as you prefer — asset type, market movement, time of the trade, the volume of trade, or any forex trading journal personalized tags. Comparison of trades — Tradervue enables you to compare between various trades in your history.

You can compare long trades and short trades, losing trades and winning trades, forex trading journal, and other personalized comparisons using tags. Activity sharing — Tradervue enables you to share your trading activity with other users on the platform.

This feature is invaluable to Tradervue users since it functions as a learning tool. When users share their trading activity, they let other users know their trading plan and the trade outcome.

Note that Tradervue values your privacy and only shares what you choose to share. You can also find what other users have shared on your dashboard. Tradervue pricing — Tradervue offers free plans to its users but with limited functionality for the platform.

Trading Journal - My Excel Spreadsheet Trading Journal (+ Free Trading Journal Spreadsheet!)

, time: 6:33Trading Journal (Stock, Forex, Futures and Options)

Day Trading Journal - CME & CBOT Futures. jor-el 1 hr 51 min ago. 1 hr 51 min ago. #3 MNQ short 2 @ close 1 @ , +, 1 left close 1 @ , +9, flat. 1, 5/7/ · Supports: Stocks, options, futures, forex Pricing: Free ( stock trades/mo), Silver ($29/mo), Gold ($49/mo) Tradervue was one of the very first trading journals to come online alongside ours and I’ve known Greg (the guy behind Tradervue) for years. Tradervue isn’t the easiest to use, but it has the best broker importing support out of all the trading journals I’ve ever tested, and Greg Estimated Reading Time: 6 mins The4xJournal software allows you to journal your forex currency trades. Some features include: Note entry for each currency pair you trade. The ability to insert and store your chart screenshots with notes about that specific trade. Insert observed or back tested trade screenshots and notes

No comments:

Post a Comment