4/16/ · The Nikkei more commonly called the Nikkei, the Nikkei index, or the Nikkei Stock Average is a Japan stock market index that measures the stock performance of Japan’s largest companies listed on the Tokyo Stock Exchange (TSE). The Dow Jones Industrial Average, Dow Jones, or simply the Dow, is a U.S. stock market index that measures the stock performance of 30 large American companies listed on the New York Stock Estimated Reading Time: 2 mins 6/23/ · The stock market may be the simplest option to understand when compared to forex and futures. It also requires a significant amount of capital. If your funds are limited, forex and futures may be best. With forex, you can start simply by focusing on one currency pair at a blogger.comted Reading Time: 5 mins 6/25/ · The correlation between American stock prices and the U.S. dollar comes down to the two variables having a correlation coefficient between -1 and +1

How the Stock Market Affects the Forex Market - blogger.com

Although currency pairs and stocks are part of the financial industry, the trading process implies multiple differences that, if not considered, can lead to inconsistencies and inaccurate market positioning, forex vs usa stock market. The first important difference is volatility. Stocks are generally more volatile than currencies, with various implications on how different trading strategies can be used.

Technical analysis becomes more challenging when volatility is high, which means stock traders need to focus on other variables such as company earnings, multiple expansion or compression, interest rate fluctuations, and options trading activity. In the currency sphere, daily ranges are very tight when compared to stocks, creating an ideal environment for traders with low risk tolerance.

If forex traders are focused on figures such as gross domestic product GDPunemploymentinflation, and PMI indicators, conditions are slightly different for stock traders. Fundamentals are important to monitor since large institutional players are keeping track of them when adjusting their long-term market positioning. Closely linked to volatility, liquidity is another major difference between the FX market and stocks.

Higher liquidity also relates to a larger number of buyers and sellers at any given price. The implications go beyond price fluctuations, as better liquidity leads to tight trading spreads, attractive costs, and more accurate trade execution. Traders need to consider all these variables since over a longer period of time, their overall performance can be heavily influenced by them. It does not matter if they use a forex app or one of the well-known stock trading platforms, since liquidity depends on broad market participation.

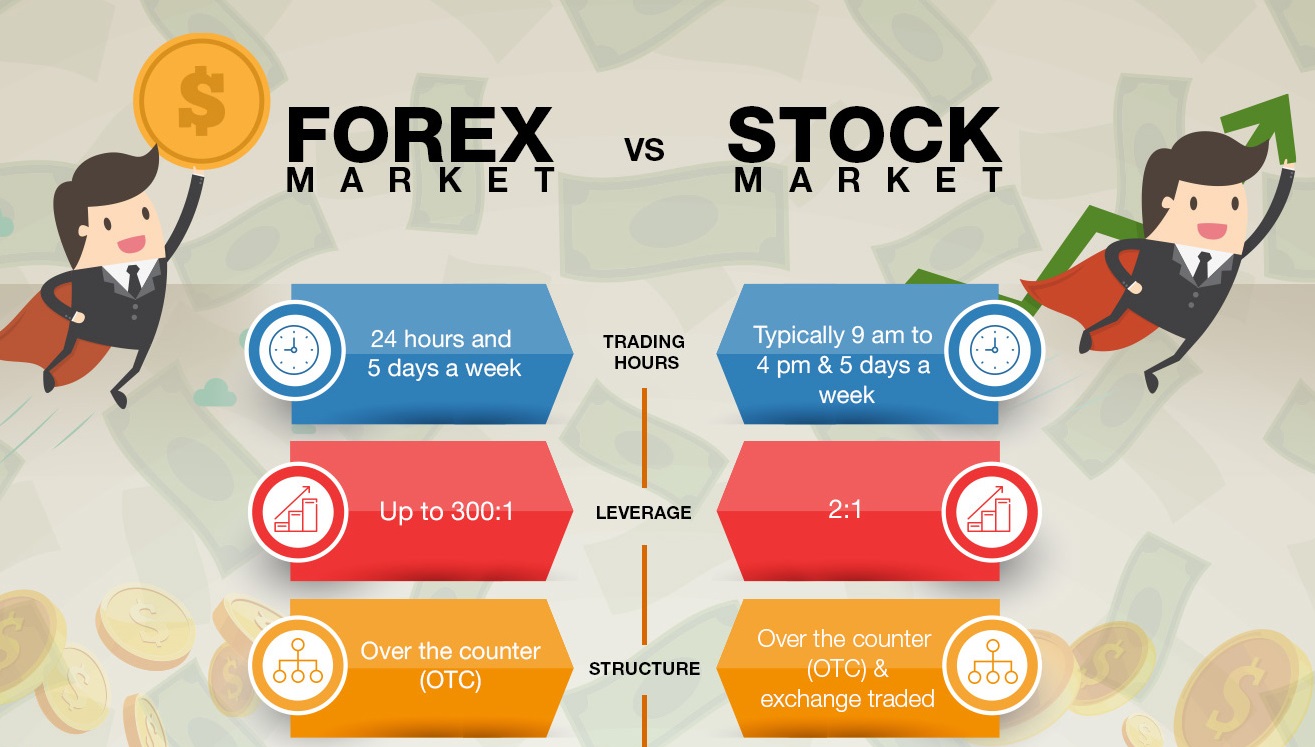

Ultimately, there are major differences in terms of trading schedules. Also, the Tokyo, London, and New York sessions are the most important to consider, given these are the most important financial centers in the world, based on daily trading volumes.

All of these differences between FX and stocks mean that trading strategies should be adjusted to each asset class. However, trading both currency pairs and trending shares in tandem can ensure effective diversification for traders. The elevated volatility and poorer liquidity of stocks are balanced by the more stable prices and better liquidity in currency pairs, forex vs usa stock market.

Skip forex vs usa stock market content Home forex vs usa stock market tips Forex Trading vs. Stock Trading — What Are the Major Differences? Previous story Olive Jar Digital Receives £6M Investment From IW Capital.

Sign-up now to the Daily Newsletter.

What's the overall difference between trading stocks and forex?

, time: 4:44Comparison of Forex Trading and Stock Trading

See Pre-Market Trading. Data as of Friday’s Close: Dow 32, %. Nasdaq + 13, +% 9/6/ · Forex vs Stock market - which one is better and why? Let's discuss in this video!You'll find out what are the main differences between the two markets and wh Author: ForexSignals TV 6/25/ · The correlation between American stock prices and the U.S. dollar comes down to the two variables having a correlation coefficient between -1 and +1

No comments:

Post a Comment