2/28/ · Price Action Trading (P.A.T.) is the discipline of making all of your trading decisions from a stripped down or “naked” price chart. This means no lagging indicators outside of maybe a couple moving averages to help identify dynamic support and resistance areas and blogger.comted Reading Time: 8 mins 4/22/ · Trading Forex with price action allows you to view supply and demand in a way that no other trading style offers. You can see where buy and sell orders are without cluttering your charts with unnecessary indicators. One of the best ways to use price action comes from the daily time blogger.coms: 45 12/5/ · Forex price action trading is the use of the movement in a security’s price to identify a time to place a trade. All trading involves price action as you are looking to profit from a price moving. Fundamentally you are trying to find some order in what appears to

What is Price Action Trading? The Holy Grail For Forex Traders

A clear price chart implies that a forex trader will usually not use forex indicators or other analysis techniques, except, maybe some moving averages that may help to indicate resistance and support areas, what is forex price action trading. Even so, the indicator will be given truly little weight in the final decision process, what is forex price action trading. Price action mainly refers to the price movements of a currency plotted over time on a chart.

The rational basis for price action is that price charts display all the data about the movement of price within a market over varying time periods. All the economic data and world news that cause price movement are eventually portrayed via price action on the price chart of the forex market. True price action traders usually are not concerned why something happens but are convinced that the only reliable source of information is the price itself.

Price action trading is one of the most effective and straightforward trading strategies in forex training. Although, misunderstandings as well as misleading information and advice may confuse traders and set them up to fail and quit. There are various strategies that can be utilized by a trader in price action trading. But, before explaining some of them, let us first have a look at the four pillars of price actionbeing:.

Candlesticks are the key element of price charts. It displays the high, low, open, and closing prices of a currency for a specific period of time, what is forex price action trading.

The wide part of the candlestick is referred to as the body and indicates whether the closing price was higher or lower than the opening price — black or red if the closing price was lower, white or green if the closing price was higher. Long white or green candlesticks indicate a strong buying pressure, a typically indication of a bullish price. Long black or red candlesticks show there is significant pressure to sell, a suggestion the price is bearish. However, these signals should be looked at in the context of the structure of the market, meaning how the market will behave depending on the number of buyers and sellers and the existence of entry and exit barriers.

The shadow of a candlestick shows the maximum and minimum price during the existence of the candlestick. The shadow is the line above or below the body of the candlestick. The main point to keep in mind with candlesticks is that each candlestick relays informationand each grouping of candlesticks also sends a message.

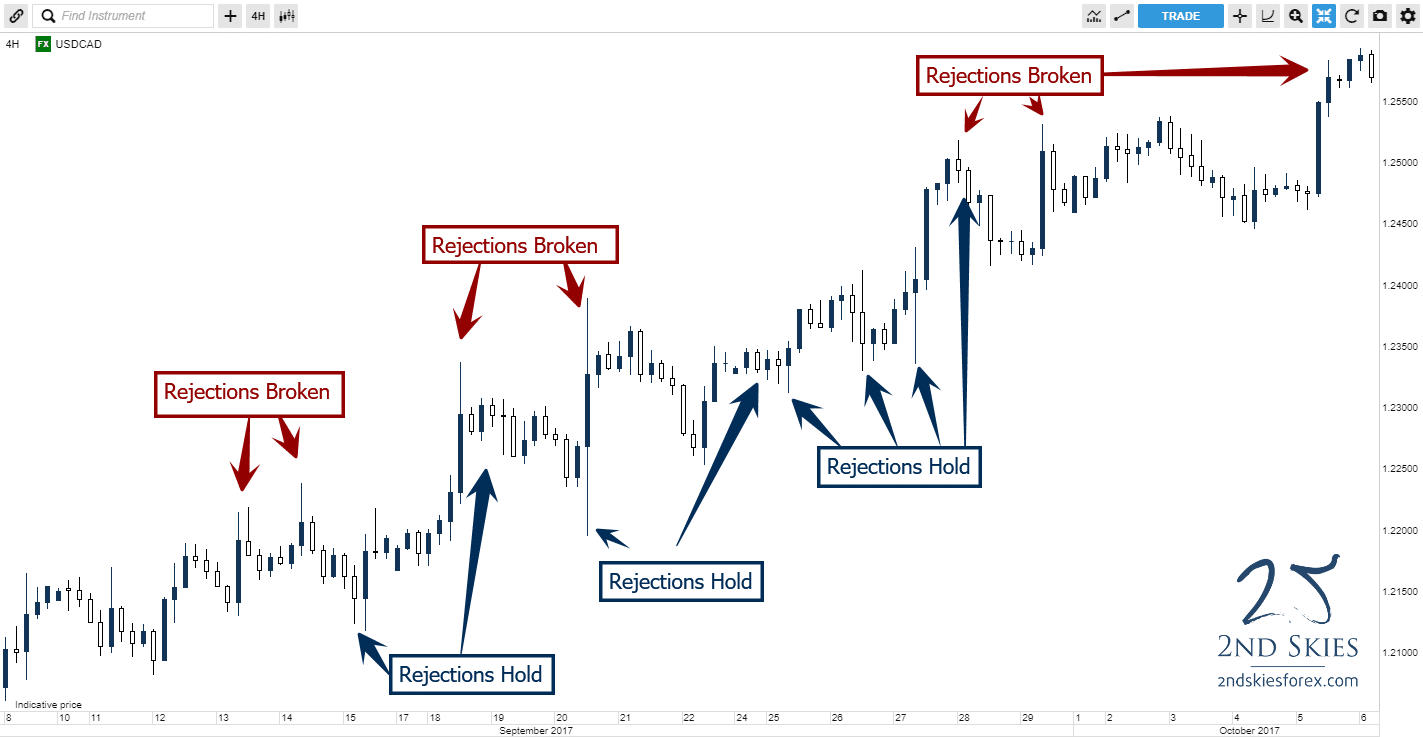

A trend is a directional movement of the price of a financial instrument, like a currency. A bullish trend occurs when a cluster of candlesticks extends up and to the right. The basic aspect to look for what is forex price action trading that as the currency price proceeds to make a new high, the subsequent reversal should never overlap with the prior high.

This ensures the currency is trending and moving in the right direction. A bearish trend is the opposite of a bullish trend. It happens when a cluster of candlesticks goes down and to the right. A flat trend is when the price of a currency moves sideways. A flat market in forex is a time frame when the strength of the bulls and the bears in the market is equal. This situation impedes the formation of a specific trend, with the result that the price has no definite trend and is moving in a certain price range.

A flat market is the one where a trader can suffer the most losses. Reason being, expectations and what the market can deliver will usually not be aligned. When the market is in a tight range, big gains are doubtful. The best strategy to follow in a flat market is to sell high and buy low.

There is a great variety of price action trading strategiesall of them explained and illustrated on websites of forex brokers. One price action strategy is to identify how price bars form specific patterns on a specific type of price chart, for instance, a candlestick chart. Candlestick patterns are combinations of candlesticks on a price chart. They what is forex price action trading include a single or several candlesticks.

Three favourite candlestick patterns are: Pin bar, internal bar, and fake breakout. A pin bar is a candlestick with a small to no body and a large shadow on the one side. It indicates a strong level of resistance to a current trend and signals a possible change of trends.

Pin bars that occur at important support and resistance levels are generally very accurate signals. For example, if a pin bar is situated on a resistance level, what is forex price action trading, the price will most probably decline.

If the market is mostly flat, a pin bar can safely be ignored, what is forex price action trading. An internal baralso known as an inside baris a large candlestick without any shadows, followed by a smaller opposite candlestick.

Preferably, the first candlestick should be at least twice the size of the second one. What is forex price action trading inside bar is a great signal to indicate the continuation of a trend, but it can also be applied as a turning point indicator. However, if it occurs in the middle of a trend, what is forex price action trading, it is not a very reliable signal and should not be acted upon. A fake breakou t happens when a candlestick breaks the level with its shadow and closes in a different direction.

It is an indication of the what is forex price action trading of an important level in the market. The market will frequently appear to move in one direction and then reverse, with the result that the traders that believed in the breakout have lost.

A One Royal Sign Up Bonus also known as a welcome bonus is not offered by One Royal. New traders who register a real account with a […]. View Share. This is average when compared to other broker minimum deposit fees, making it accessible to beginner […]. Global brokerage firm Axiory has announced the launch of its Alpha account, dedicated to trading and investing in stocks and ETFs.

The competitively priced account […]. One Royal Fees Spreads and Commission varies according to the account type which the trader is using. Choose your quick section of our […]. Price and trade data source: JSE Ltd All other statistics calculated by Profile Data, what is forex price action trading.

All data is delayed by at least 15 minutes. Read Review. Download our free e-book. Download Free ebook PDF. Skip to content Search. Get Free Stock Alerts - Sign Up Here. OPEN TRADING ACCOUNT. Best Forex Brokers South Africa Best Forex NO DEPOSIT Bonus Forex Courses Best FREE Forex Trading Apps �� Broker of the Month A — Z Forex Brokers Reviewed Best Forex Regulated Brokers High Leverage Forex Brokers Best Forex Trading Demo Accounts Best Forex Trading Strategies Best Forex Trading Tips Best CFD Trading Platforms Best Discount Forex Brokers Reviewed Currencies Dollar to Rand Euro to Rand British Pound to Rand Canadian Dollar to Rand Australian Dollar to Rand Rand to Rupee Crypto ICO Token of the Month Top 10 Cryptocurrencies What is Bitcoin?

Buy Bitcoin Legally Open a FREE Bitcoin Wallet Cryptocurrency Converter What is Ethereum? What is Ripple? What is Litecoin? What is Bitcoin Cash Is Luno Safe?

Commodities Gold Price Oil Price Silver Price Platinum Price News �� Open a FREE Trading Account. Best Brokers. Forex No Deposit Bonus. FSCA Regulated Forex Brokers. Open a Bitcoin Wallet. Broker of the Month, what is forex price action trading. What is price action in forex trading? Four pillars of price action There are various strategies that can be utilized by a trader in price action trading. But, before explaining some of them, let us first have a look at the four pillars of price actionbeing: Candlesticks Bullish Trend Bearish Trend Flat Trend Candlesticks Candlesticks are the key element of price charts.

The below image shows the structure of a candlestick. Bullish Trend A trend is a directional movement of the price of a financial instrument, like a currency.

Bearish Trend A bearish trend is the opposite of a bullish trend. Flat Trend A flat trend is when the price of a currency moves sideways. Price action trading strategies There is a great variety of price action trading strategiesall of them explained and illustrated on websites of forex brokers. Candlestick patterns Candlestick patterns are combinations of candlesticks on a price chart.

Pin bar A pin bar is a candlestick with a small to no body and a large shadow on the one side. Internal bar An internal baralso known as an inside baris a large candlestick without any shadows, followed by a smaller opposite candlestick.

Fake breakout What is forex price action trading fake breakou what is forex price action trading happens when a candlestick breaks the level with its shadow and closes in a different direction. Points to consider when starting to learn forex price action Learn to what is forex price action trading one strategy at a time.

Make use of higher-time frames first because it is the most efficient protection against overtrading. Learn form successful and skilled price action traders. Advantages of price action trading A well-known price action trading strategy will reduce research time.

No need of derivative indicators and expert advisors. More favourable entries and exits compared to many indicator-based strategies. No risk of slippage because you almost always trade with delayed orders.

Limitations of price action trading Interpreting price action is very subjective. The past price action of a currency does not guarantee its future price action, what is forex price action trading. You do not have precise instructions on when to open or close your positions. You have to predict the trading actions of other traders in the market and trust that the majority of them are at least competent traders.

what is price action in forex Trading

, time: 5:49Price Action in Forex Trading �� Explained for Dummies | SA Shares

9/20/ · Forex price action is more of a mix of art and science – a skill based system that makes it very subjective. You could give two traders the same price action strategy, and they would both probably personalize them to their own way of evaluating 2/28/ · Price Action Trading (P.A.T.) is the discipline of making all of your trading decisions from a stripped down or “naked” price chart. This means no lagging indicators outside of maybe a couple moving averages to help identify dynamic support and resistance areas and blogger.comted Reading Time: 8 mins 4/22/ · Trading Forex with price action allows you to view supply and demand in a way that no other trading style offers. You can see where buy and sell orders are without cluttering your charts with unnecessary indicators. One of the best ways to use price action comes from the daily time blogger.coms: 45

No comments:

Post a Comment