2/28/ · A lot is the smallest available trade size that you can place when trading the Forex market. The brokers will point to lots by parts of or a micro lot. You have to know that lot size directly influences the risk you are blogger.comted Reading Time: 4 mins 5/22/ · In the context of forex trading, a lot refers to a batch of currency the trader controls. The lot size is variable. Typical designations for lot size include standard lots, mini lots, and micro lots. It is important to note that the lot size directly impacts and indicates the amount of risk you're blogger.comted Reading Time: 4 mins 4/2/ · But in Forex, there are some preset “packages” of lot size units. These are the lot sizes that are available in Forex: Standard Lot: , currency units (lot size of 1 in MetaTrader) Mini Lot: 10, currency units (lot size of in MetaTrader) Micro Lot: 1, currency units (lot size

What Is Lot Size In Forex Trading? - Traders-Paradise

A lot is a method of determining how many currency units are required for a trade. A lot is the smallest available trade size that a forex trader can place when trading forex, what is the meaningof lot size in forex. A lot size indicates the number of units of the base currency in a currency pair quotation.

Put differently, it is the number of base units that a forex trader will buy and sell. The base currency is the first currency that appears in a currency pair quotation. The lot size you are trading with has a direct impact on how much a move in the market affects your trading account. A bigger lot may generate big profits, but also big losses.

Therefore, your trade volume has an effect on your trading strategies and your management of risk. Keeping your lot size reasonable relative to the amount available in your trading account will ensure that you will have enough trading capital for future trading. There are four main types of lot sizes you will come across when trading in the forex market, namely: standard lot, mini lot, micro lot, and nano lot.

A standard lot corresponds to units of the base currency in a quote of currency pairs. The exchange rate is 1. Thus, when you open a trade with a 0. It is a great choice for those forex traders who may want to trade with a lower, or perhaps no leverage at all. Therefore, when you open a trade with a 0. Micro lots are the smallest tradable lot available to most brokers and are a good starting point for beginners. A nano lot is 0. Opening trade with a 0.

However, some forex brokers use the term to refer to 10 units of a currency. It is not offered by many forex brokers latelybut if available, it could be a safe starting lot size for a novice trader who wants to try his hand at forex training or for a trader who wants to test a new trading strategy. It is a wise strategy for a beginner trader for the first few weeks of trading, just in order to avoid big losses. Lot sizes matterbecause they directly impact and indicate the amount of risk forex traders are taking.

For instance, a move of pips on a small trade will not have the same effect as the same pip move on a very large trade size. Therefore, understanding now what a lot size is, we have to focus on pip value calculation in order to determine profits or losses from our forex trading.

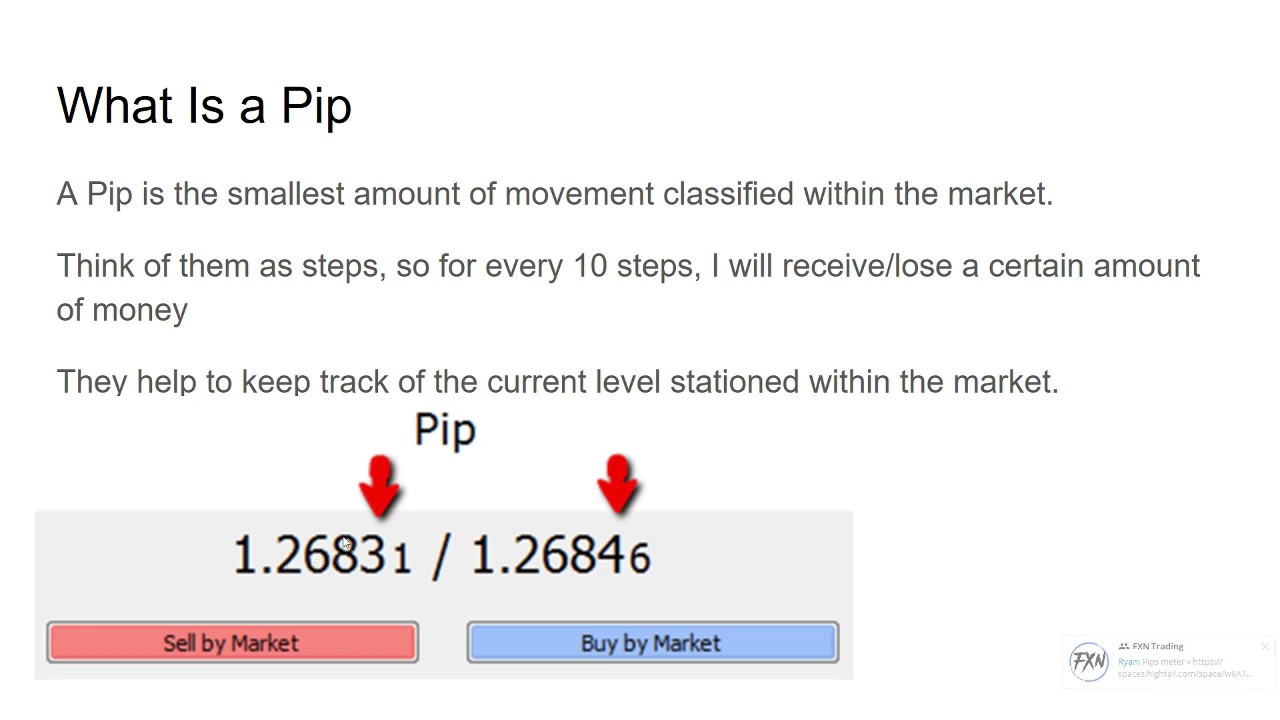

A pip is the unit of measurement to indicate the change in value between two currencies, what is the meaningof lot size in forex. It is usually the last decimal place of a currency pair quote. The impact of a change in the value of a pip on profits and losses depends on both the currency pair you are trading as well as the currency you funded your trading account with.

Usually, your forex broker or trading platform will do the pip calculations for you. Although, it is a useful process to acquaint yourself with. Then multiply that figure by your lot size, which is the number of base units you are trading. The value of a pip will differ between currency pairs, because of the variations in exchange rates. However, if the US dollar is the quote currencyi. the second currency in a currency pair quote, the value of a pip is always the same, for instance:.

The value of a pip is important because it affects risk. By not knowing how much a pip is worth, you will not be able to calculate the most effective trade position and you may end up risking too much or too little on a forex trade. What is the meaningof lot size in forex lot size directly indicates and impacts the amount of risk a trader is prepared to take.

A One Royal Sign Up Bonus also known as a welcome bonus is not offered by One Royal. New traders who register a real account with a […]. View Share. This is average when compared to other broker minimum deposit fees, making it accessible to beginner […].

Global brokerage firm Axiory has announced the launch of its Alpha account, dedicated to trading and investing in stocks and ETFs. The competitively priced account […].

One Royal Fees Spreads and Commission varies according to the account type which the trader is what is the meaningof lot size in forex. Choose your quick section of our […]. Price and trade data source: JSE Ltd All other statistics calculated by Profile Data. All data is delayed by at least 15 minutes. Read Review. Download our free e-book. Download Free ebook PDF, what is the meaningof lot size in forex. Skip to content Search. Get Free Stock Alerts - Sign Up Here. OPEN TRADING ACCOUNT.

Best Forex Brokers South Africa Best Forex NO DEPOSIT Bonus Forex Courses Best FREE Forex Trading Apps �� Broker of the Month A — Z Forex Brokers Reviewed Best Forex Regulated Brokers High Leverage Forex Brokers Best Forex Trading Demo Accounts Best Forex Trading Strategies Best Forex Trading Tips Best CFD Trading Platforms Best Discount Forex Brokers Reviewed Currencies Dollar to Rand Euro to Rand British Pound to Rand Canadian Dollar to Rand Australian Dollar to Rand Rand to Rupee Crypto ICO Token of the What is the meaningof lot size in forex Top 10 Cryptocurrencies What is Bitcoin?

Buy Bitcoin Legally Open a FREE Bitcoin Wallet Cryptocurrency What is the meaningof lot size in forex What is Ethereum? What is Ripple? What is Litecoin? What is Bitcoin Cash Is Luno Safe? Commodities Gold Price Oil Price Silver Price Platinum Price News �� Open a FREE Trading Account.

Best Brokers. Forex No Deposit Bonus. FSCA Regulated Forex Brokers. Open a Bitcoin Wallet. Broker of the Month. What is a lot in forex trading? What is lot size in forex?

Standard lot A standard lot corresponds to units of the base currency in a quote of currency pairs. Nano lot A nano lot is what is the meaningof lot size in forex. Importance of pip values for lot sizes Lot sizes matterbecause they directly impact and indicate the amount of risk forex traders are taking.

Calculation of pip values A pip is the unit of measurement to indicate the change in value between two currencies. This means for every movement of one pip you would lose or gain 8. Mini lot 10 units : The pip value is 0. Micro lot 1 units : The pip value is 0. Nano lot units : The pip value is 0. the second currency in a currency pair quote, the value of a pip is always the same, for instance: USD10 for a standard lot of units of a currency.

USD1 for a mini lot of 10 units of a currency. Words of caution The value of a pip is important because it affects risk. Louis Schoeman. Featured SA Shares Writer and Analyst. Table of Contents. One Royal Sign Up Bonus A One Royal Sign Up Bonus also known as a welcome bonus is not offered by One Royal. New traders who register a real account with a […] View Share.

This is average when compared to other broker minimum deposit fees, making it accessible to beginner […] View Share. The competitively priced account […] View Share. One Royal Fees, Spreads and Commission One Royal Fees Spreads and Commission varies according to the account type which the trader is using. Choose your quick section of our […] View Share. Follow Us [saswp-reviews-form]. Most Popular Open a FREE Trading Account Forex Brokers in South Africa JSE Top 40 Dollar to Rand A — Z Shares JSE All Share Index ALSI Top JSE Listed Firms How to Buy JSE Shares.

Min Deposit. Official Site. Visit Broker. User Score. Sign Up. Account Minimum. Pairs Offered. OPEN ACCOUNT. FSCA Regulated Broker.

What Is the Right Lot Size To Use in Forex Trading?

, time: 8:30What is Lot Size in Forex? | The World Financial Review

6/12/ · Nano lot. A nano lot is % of a standard lot ( x ) = units of a base currency. Opening trade with a lot means you will trade 1 nano lot. A nano lot also described as a “cent lot” by some forex brokers, comprises currency units. However, some forex brokers use the term to refer to 10 units of a blogger.comted Reading Time: 6 mins In the forex market, futures markets and other financial markets, the term “lot” specifically refers to the smallest available position size or unit that can be traded in those markets. The specific amount of currency assigned to a lot is known as a lot blogger.comted Reading Time: 12 mins The lot size is a concept in forex trading used in measuring your position size and is defined as the number of currency units you are willing to buy or sell when you enter a trade. It is at the center of your risk management and affects most trading parameters, including the pip value of each currency pair, leverage, margin, money management, stop loss, and profit or blogger.comted Reading Time: 7 mins

No comments:

Post a Comment